Cheltenham Township seeks public comment regarding the Elkins Estate Tax Increment Financing Plan.

“A plan to breathe new life into one of Cheltenham’s historic gems, the Elkins Estate (also known as the Dominican Retreat at 1750 Ashbourne Road in Elkins Park), was presented to the Cheltenham Township Board of Commissioners in a public hearing at its regularly-scheduled meeting on January 23, 2019,” according to a statement issued by Cheltenham Township.

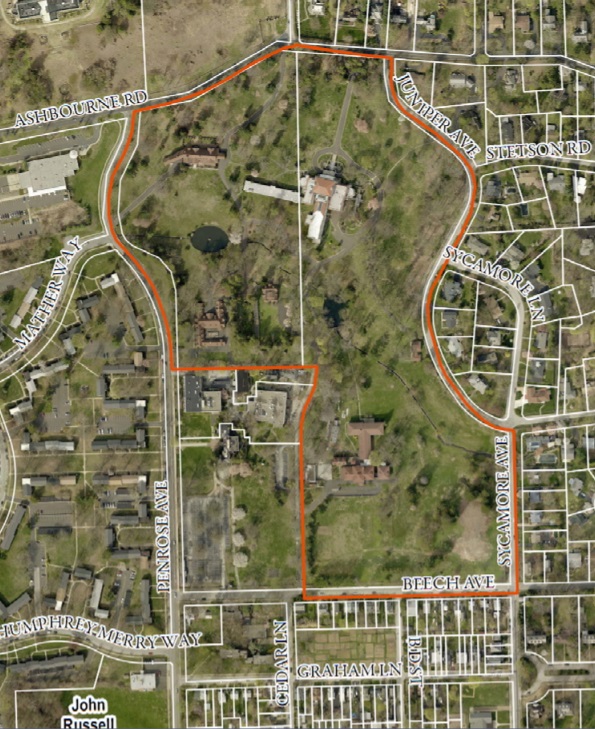

“The presentation by Ms. Amee Farrell, the attorney representing the developer, Landmark Developers of Jersey City, New Jersey, focused on presenting its Tax Increment Financing Plan (TIF), the financing scheme necessary to make the vision for this approximately 45-acre property a reality,” the statement continued. “The vision involves preserving and renovating the buildings on site into a commercial hotel and event facility to include 110 hotel rooms, five guest cottages, two artist-in-residence apartments, an indoor and outdoor restaurant, event spaces, a distillery, wellness center and spa, a helipad and approximately 501 parking spaces, along with 120 new jobs for Cheltenham Township.”

According to the statement from Cheltenham Township, “In addition to the commercial space, this project will provide several ‘public benefit’ areas as part of the TIF District (the three parcels comprising of 1750 Ashbourne Road), including: public access to the public gardens, walking trails, art, and sculpture gardens located throughout the property during daylight hours; use of the lobby space by the public; ability to rent the teaching kitchen, classrooms, recording studio, and conference center facilities; and public access to the band shell and community gardens on the property.”

“In addition to the public benefit of this TIF, Landmark has also agreed to place covenants on the property to preserve the historic buildings and facades and to restrict the property from future residential development,” the statement continued. “Ms. Farrell said the buildings on the Elkins Estate were designed by Mr. Horace Trumbauer and are some of the last remaining buildings of their kind in the country. These historically-significant buildings will continue to be owned and maintained by Landmark Developers, who specialize in re-purposing historical properties. Ms. Farrell said, ‘The developers consider the Elkins Estate as the crown jewel of their properties.'”

Tax increment financing is a process in which local taxes on the real estate are collected, but are then provided back to the developer.

“The TIF involves the developer paying 100% of the taxes assessed to the taxing bodies (Township, School District and County) each year,” according to the statement from Cheltenham Township. “The taxing bodies then pay the taxes paid by Landmark, in an amount according to the schedule established in the TIF Plan, to the Montgomery County Redevelopment Authority. The [Montgomery County] Redevelopment Authority is responsible for distributing the funds back to Landmark for approved project costs, as defined in the TIF Plan, until the project costs are paid back to Landmark or the 20-year period expires.”

According to the statement from Cheltenham Township, “The estimated approved project costs are valued at $8,485,000 and include: acquisition of the property; professional fees for legal, financing, architect, engineer and environmental assessments; and equipment and furnishing for public access improvements such as the band shell, recording studio, kitchen and classrooms, and conference center facilities. It is estimated that an additional $16,447,000 will be invested into the improvement of this property.”

“To make this project work financially,” the statement continued, “Landmark has asked the taxing bodies to adopt the following taxing schedule, which is described in more detail in the TIF Plan:”

“Years 1-3: 100% of the real estate taxes assessed on the property will be paid to the Redevelopment Authority for Landmark to use for approved project costs.”

“Years 4-10: $100,000 of the taxes received by the taxing bodies will be received by the taxing bodies in their proportionate share and the remainder of the taxes assessed will be paid into the Redevelopment Authority to be used by Landmark for approved project costs.”

“Years 11-20: The amount of taxes retained by the taxing bodies and the amount submitted to the Redevelopment Authority will based on the amount of taxes paid by Landmark that year. The higher the amount of taxes collected, the smaller the percentage of taxes retained by the taxing bodies. For example, if $100,000 or less in taxes are collected, the taxing bodies will retain 100% of the taxes collected, but they will retain 16.5% of the taxes collected, if the annual taxes collected, in total, are $600,000 or more.”

“Landmark will be responsible for any millage increases; the tax rate is not frozen during this 20-year period,” the statement continued. “According to Township Solicitor Mr. Joseph Bagley, ‘The Elkins Estate is currently tax exempt, so any tax monies received is revenue the taxing authorities have not seen from this property in over 100 years.'”

According to the statement from Cheltenham Township, “Over the 20-year period, it is estimated that the School District will receive $1,758,192 in tax income, the Township will receive $1,070,758 in tax income, and the County will receive $3,194,846 in tax income. The County’s estimated income is higher than the other two taxing bodies because they receive a hotel tax.”

“[Cheltenham] Township Commissioner Brad Pransky said,” according to the statement, that ‘This project is a significant step in providing a commercial tax base to help reduce the increasing burden on Cheltenham’s residential tax base. We look at this project as a seed for future economic development, not only in the area surrounding the Elkins Estate, but throughout the Township. The TIF has made this property a viable development opportunity.'”

The statement from Cheltenham Township indicated that “The Cheltenham School Board adopted the taxing schedule at its January 15, 2019, meeting and the Montgomery County Commissioners ratified the TIF District and taxing schedule at its January 17, 2019 meeting. The final step for approval of this TIF District is a three-week public comment period and consideration for adoption of the TIF District and taxing schedule by the Board of Commissioners at its meeting on February 20, 2019.”

“Following approval of the TIF District for this property,” the statement continued, “Landmark plans to close on the property in the spring of 2019. Landmark has already received zoning approval for this project, but will be submitting a formal land development plan for review following purchase of the property.”

“Public comments on the TIF District can presented,” the statement concluded, “in writing to the Office of the Township Manager either by email or [by postal] mail:

Office of the Township Manager

Cheltenham Township

8230 Old York Road

Elkins Park, PA 19027

no later than Friday, February 15, 2019. Oral comment will be considered at the Board of Commissioners’ meeting on February 20, 2019.”

You can view details on these plans by clicking here, clicking here, and by clicking here.

The photograph is provided courtesy of Cheltenham Township, 2019.

The map is provided courtesy of the Montgomery County Planning Commission, 2018.